Just a few years ago, when discussing furniture production—especially tables, chairs, and other items for homes and public projects—the conversation often revolved around Malaysia, and more significantly, China. Now, however, Vietnam has emerged as the compelling new alternative in this furniture industry. In this article, we will dive deep into a comprehensive analysis and comparison of the furniture manufacturing landscape across Vietnam, China, and key countries in the Southeast Asian region in recent years.

Vietnam: The New Furniture Manufacturing Hub

Vietnam has rapidly cemented its position as one of the world’s top five furniture exporters, consistently supplying major markets including the United States, Japan, and the European Union. This ascent is driven by several compelling advantages that make it a preferred choice over traditional manufacturing hubs.

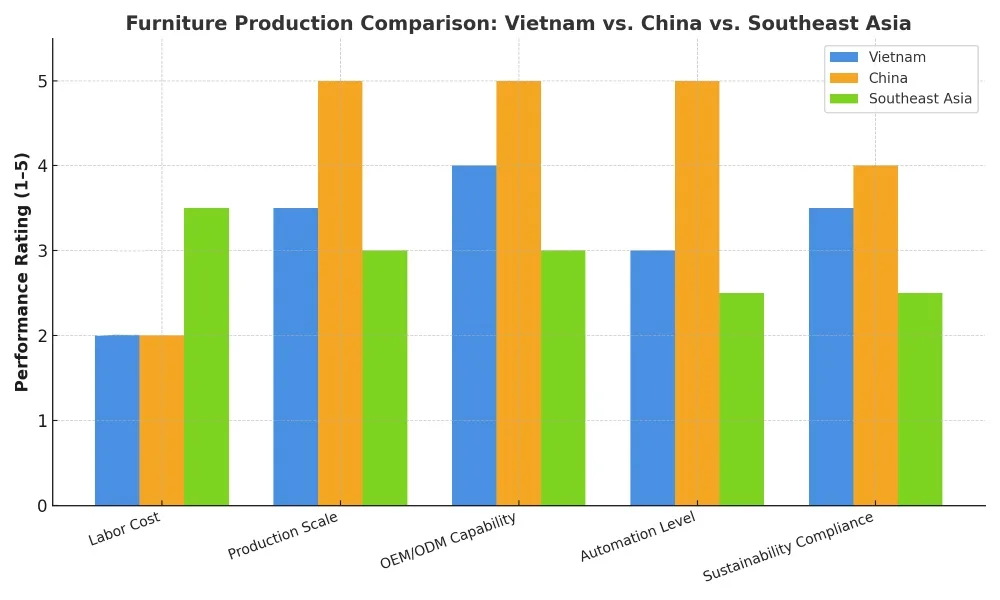

First and foremost is the Cost Advantage: Vietnam’s labor costs remain significantly lower than those in China, enabling manufacturers to offer highly competitive pricing without compromising quality. Furthermore, many facilities practice Integrated Production, combining processes like steel fabrication, powder coating, plywood pressing, and upholstery within a single operation. This comprehensive approach minimizes outsourcing, ensures tighter quality control, and ultimately shortens lead times.

Manufacturers in Vietnam also demonstrate strong OEM and ODM Capabilities, proving flexible in both developing custom designs and creating entirely new product concepts for their global clientele. Crucially, most export-oriented factories adhere to International Standards, complying with certifications like ISO, BIFMA, and EN. Moreover, local timber suppliers operate under the strict VPA/FLEGT legality system, ensuring alignment with rigorous EU requirements.

Ultimately, Vietnam’s key strength lies in its ability to deliver cost-effective and design-flexible products, particularly in areas like KD (knock-down) office furniture, auditorium chairs, and metal-frame wood furniture.

China: Scale, Speed, and Supply Chain Depth

China remains the global benchmark for large-scale furniture production thanks to an industrial ecosystem that is virtually unmatched in its depth. This comprehensive supply chain covers every necessary component, from specialized hardware and complex mechanisms to packaging, upholstery foam, and advanced logistics.

China’s tremendous production scale and automation are key advantages, enabling rapid prototyping and the efficient fulfillment of massive orders, supported by decades of experience in international trade and export compliance. However, manufacturers now face significant challenges. Labor and overhead costs are consistently higher than in emerging hubs like Vietnam and other Southeast Asian nations.

Furthermore, certain product categories are subject to anti-dumping duties and tariffs in major markets like the U.S., driving global buyers to diversify their sourcing under the “China+1” strategy. Despite these shifts, China remains the ideal location for mechanism-rich furniture, complex adjustable systems, and large-scale OEM programs that demand high speed, precision, and immense capacity.

Other Southeast Asian Countries: Focused Niches

Outside of Vietnam and China, several other countries in Southeast Asia are actively strengthening their roles in specialized niche segments. Indonesia, for instance, excels in solid wood, rattan, and outdoor furniture, making full use of its abundant local raw materials and established craftsmanship. Meanwhile, both Malaysia and Thailand have carved out a reputation for precision joinery and reliable quality, focusing heavily on contract furniture and hospitality projects.

Furthermore, countries like Cambodia and the Philippines are increasingly attracting attention for basic assembly and component production dueately to their lower labor costs, although their industrial infrastructure is still less developed compared to their neighbors. While these nations cannot yet rival the sheer capacity of Vietnam or China, they collectively offer valuable diversification opportunities for global brands seeking greater regional resilience in their supply chains.

Outlook for 2025 and Beyond

The global furniture market is evolving toward sustainable production, digital design integration, and multi-source supply chains. Vietnam is expected to continue its growth, targeting over US$17 billion in furniture and wood exports in 2024–2025. China will remain dominant in high-volume, technology-driven manufacturing. And other Southeast Asian countries will grow as secondary sourcing hubs, supported by regional trade agreements.

Conclusion: Making the Right Choice

Ultimately, each manufacturing hub in Asia presents a distinct value proposition for furniture buyers. The decision rests on prioritizing your business needs:

Choose Vietnam if your goal is achieving a balanced mix of competitive cost, design flexibility, and reliable export quality. Vietnam is the optimal hub for sustained growth.

Choose China when your primary requirements are extreme volume, high-speed production, and advanced automation. China remains unmatched for scale and complex, mechanism-rich products.

Choose other Southeast Asian countries (such as Indonesia, Malaysia, or Thailand) to leverage specialized solid-wood craftsmanship, target niche segments, or strategically diversify risk away from the two primary giants.

By clearly understanding these regional distinctions, global buyers can confidently build resilient, cost-effective, and sustainable supply chains that are perfectly tailored to meet the ever-evolving demands of the modern furniture market.

Ready to Start Manufacturing in Vietnam?

If you’re interested in furniture design and manufacturing in Vietnam, we invite you to get in touch with us using the contact details below. Our team is ready to answer your questions and assist with any inquiries.

MINH DUC PUBLIC FURNITURE CO.,LTD

Address: No. 47/2, Phu Do, Nam Tu Liem, Hanoi, Vietnam

Office: Villa H02-L11 An Phu, Duong Noi, Ha Dong, Hanoi, Vietnam

Hotline/ Zalo/ Whatapp: +84 908314939